Guide to Register as a Candidate, Banking Requirements, and How to Close Out a Campaign Account

How to Register as a Candidate

The below information details the steps required for each specific type of candidate (statewide or state district candidates, county and municipal candidates, and local school election candidates) to register.

Statewide or state district candidates (legislature, district court judge, and public service commission):

- 1. You are required to file a C-1 Statement of Candidate form in the user-friendly Candidate Electronic Reporting System (CERS).

- - Form C-1 must be filed within five days after receiving or spending money, appointing a campaign treasurer, or filing for office (whichever comes first).

- - Reference this Candidate Guide to Navigating CERS to create a CERS account and file your C-1 Statement of Candidate (See Part 1, pages 3-6).

- 2. You must file with the Secretary of State. Candidate filing - see the Secretary of State's website.

- 3. You are also required to file a D-1 Business Disclosure Statement form within five days of filing for office. Reference this D-1 Business Disclosure Guide to file a D-1 Business Disclosure form.

County and Municipal Candidates:

- 1. You are required to file a Statement of Candidate C-1A form.

- - A C-1A form must be filed within five days after receiving or spending money, appointing a campaign treasurer, or filing for office, whichever occurs first.

- - File a C-1A form with the COPP's office by filing electronically in the user-friendly CERS system (Reference the Candidate Guide to Navigating CERS ).

- - Please note that form C-1A is only considered complete when the candidate lists a campaign treasurer and provides the name and address for the campaign depository (bank). Candidates for these offices will also want to speak with their county elections administrator to see if any local registration requirements apply.

- 2. You must file with your local election office.

Local School Election Candidates:

- If you are running for a local school election position,all candidates will need to register with their school district. Not all candidates (based on their school district) will need to register with the COPP. Reference OPI elections to see a list of schools whose candidates must register with the COPP by filing a C-1A form.

- - A C-1A form must be filed within five days after receiving or spending money, appointing a campaign treasurer, or filing for office, whichever occurs first.

- - File a C-1A form with the COPP's office by filing electronically in the user-friendly CERS system (Reference the Candidate Guide to Navigating CERS).

- - Please note that form C-1A is only considered complete when the candidate lists a campaign treasurer and provides the name and address for the campaign depository (bank). Candidates for these offices will also want to speak with their county elections administrator to see if any local registration requirements apply.

But I won't be receiving or spending any money on campaign activity. Do I still need to file a Statement of Candidate?

Yes. All candidates, regardless of intended financial activity, must file a Statement of Candidate online in CERS. Similarly, the treasurer and bank information are required information. Please note that the COPP only requires the name and address of the bank- account numbers, routing numbers, etc. are NOT REQUIRED!

Pro tip: if you do not intend on raising or expending money as part of your campaign, list yourself as the treasurer, and the name and address of your personal bank for the campaign depository information.

NOTE: As of October 2019, and in accordance with 13-37-225 and 226 MCA, all candidates must:

- - File all forms electronically in the Campaign Electronic Reporting System (CERS).

- - To help you file campaign finance forms confidently, reference the Candidate Guide to Navigating CERS.

- - All candidates will follow the same reporting schedule (See the Reporting Calendars page for report periods and report due dates).

1) You are required to file a Statement of Candidate as an exploratory candidate. Every candidate has the option to file using the user-friendly CERS system (reference this Candidate Guide to Navigating CERS).

- 1- Statewide or state district candidates: Candidates for statewide or state district offices are required to file a C-1 Statement of Candidate using the CERS system.

- 2- County or municipal candidates: Candidates for municipal and county offices file a C-1A Candidate Statement form with the COPP's office by filing electronically in the user-friendly CERS system (Reference this Candidate Guide to Navigating CERS).

- 3- Local school election candidates: If you are running for a local school election position, all candidates will need to register with their school district. Not all candidates (based on their school district) will need to register with the COPP. Reference OPI Elections (sorted by county) to see a list of schools whose candidates must register with the COPP by filing a C-1A form.

- - File a C-1A form with the COPP's office by filing electronically in the user-friendly CERS system (Reference this Candidate Guide to Navigating CERS).

2) How do I file as an exploratory candidate in the CERS system?

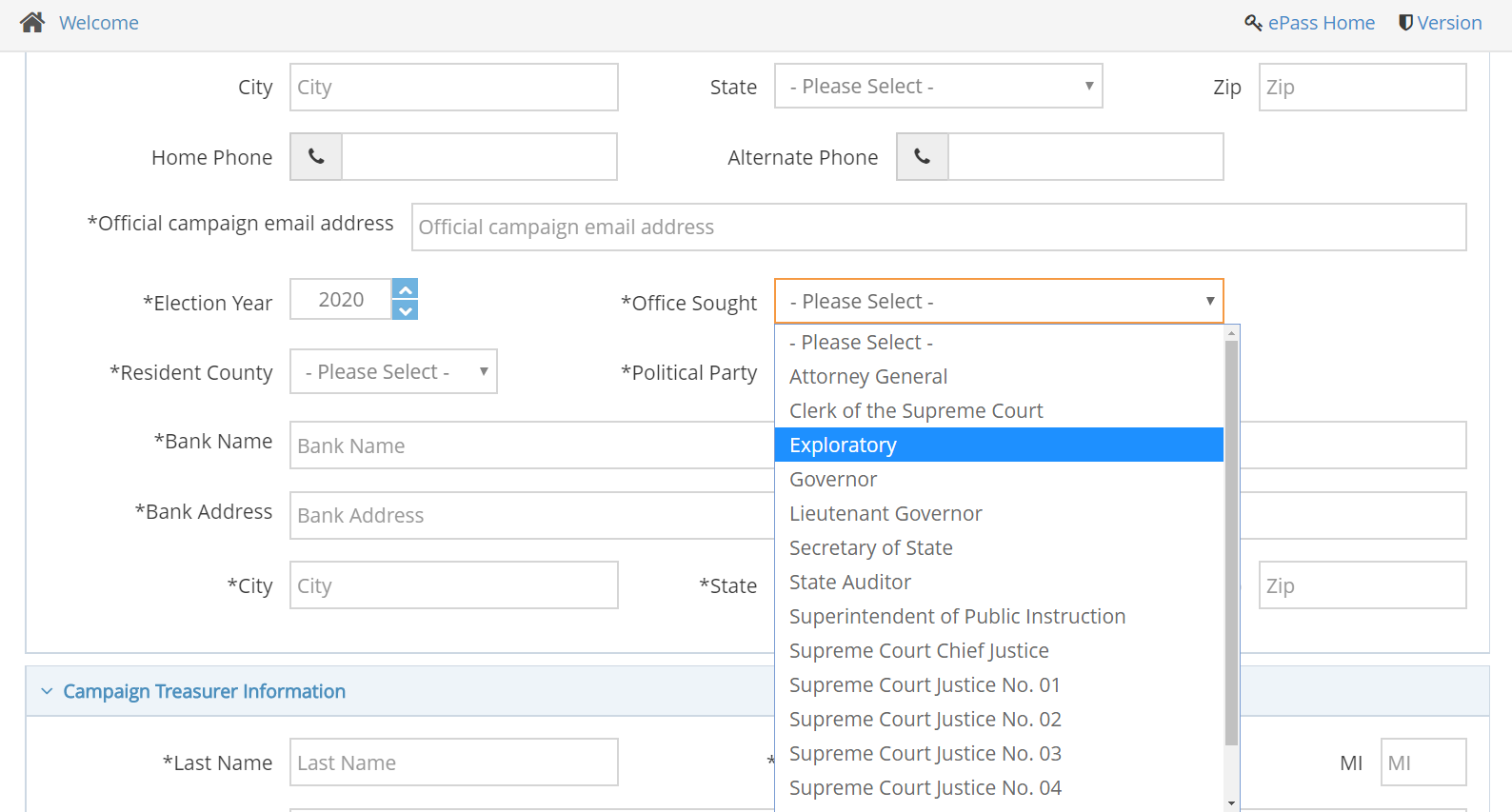

You must file a Statement of Candidate in CERS. Follow the steps in this Candidate Guide to Navigating CERS. When you get to Part 1, Step 3 (page 5), you must select a campaign type. Your options are 1) City 2) County, 3) School, 4) State District, or 5) Statewide. Once you’ve selected your campaign type, and after you begin entering in your information in the Candidate Information section, you can specify that you are running an Exploratory campaign under the drop-down options for “Office Sought” (see image below).

3) What campaign finance requirements must I comply with as an exploratory candidate?

- Campaign finance reporting: You are required to follow the same campaign finance laws and requirements as all other candidates (see details at this link). If a county, city, or school candidate’s campaign meets or exceeds $500.00 in combined expenditures (expenses) and contribution activity—meaning that the total sum of contributions (including personal contributions) received by the campaign plus expenditures made is $500.00 or more—that candidate is required to file periodic C-5 campaign finance reports with the COPP. County, city, and school candidates who do not meet or exceed the $500.00 threshold during the duration of their campaign are not required to file C-5 financial reports. All candidates for statewide or state district offices are required to file periodic campaign financial reports regardless of actual expenditure or contribution activity.

- Contribution limits: Based on the designated “class” of offices you are considering (Statewide, state district, county or municipal, or school), you may only accept the lowest amount based on the class you file for as an exploratory candidate.

5) What do I need to do once I decide which specific office I will run for?

1- You will need to file an amended Statement of Candidate form that designates the specific office you are seeking.

2- Once you have completely filed an amended report, you will be eligible for the campaign contributions based on the specific office you are running for.

WHAT INFORMATION IS TO BE REPORTED?

Pursuant to Montana Code Annotated 13-37-201, 13-37-202, and 13-37-205, the following information is required to be reported:

- - full name and complete mailing address of the treasurer;

- - full name and complete mailing address of any deputy treasurer; and

- - full name and complete address of the depository in which the campaign account is located.

PLEASE NOTE:

- 1) A candidate may appoint themself as the campaign treasurer or deputy treasurer. Such an appointment subsequently may be changed by amending the candidate's Statement of Candidate in CERS.

- 2) The treasurer of a candidate’s campaign is responsible for keeping detailed accounts of all contributions received and expenditures made by the campaign. The treasurer of a candidate’s campaign is the individual to whom correspondence and notices will be sent unless the commissioner’s office is otherwise directed.

- 3) Funds collected during a contested primary that are meant for general election contributions must be maintained in a separate account. Primary and general campaign funds must be managed in separate accounts.

- 4) Are you filing a C-1A Form? A separate bank account must be established for a campaign in which any funds, including the candidate’s personal funds, will be received or spent, that is, if Box B or C is checked on the Affidavit of Reporting Status on Form C-1A.

- * In accordance with 44.11.304(2)Administrative Rules of Montana, if Box B has been checked and more than $500 subsequently is received and/or expended, an initial financial report (Form C-5) must be filed within five days of exceeding $500 and financial reports must be filed according to schedule.

- 5) Pro tip: if you do not intend on raising or spending money as part of your campaign, list yourself as the treasurer, and the name and address of your personal bank for the campaign depository information.

When filling out the Statement of Candidate, I am asked if I am a "B" or "C" box candidate. What is the difference between a 'B' and 'C' box candidate?

On the Statement of Candidate, the candidate must indicate if they are a ‘B’ or ‘C’ box candidate. 'B' box candidates "certify that I expect the total amount of contributions or expenditures will not exceed $500 (including personal funds)" for their campaign and are not required to file C-5 campaign finance reports with our office. Simply put, candidates can maintain 'B' box status and remain exempt from campaign finance reporting requirements if the combination of contributions received by the campaign and expenditures made does not exceed $500.

'C' box candidates certify that "I expect to receive contributions and/or make expenditures exceeding $500 (including personal funds)" and therefore must file C-5 campaign finance reports on the appropriate schedule. So, if the candidate’s combination of contributions received and expenditures made exceeds $500, that candidate would be a ‘C’ box candidate and would need to file C-5 campaign financial reports according to schedule. If a 'B' box candidate exceeds $500 in expenditure and contribution activity, they will need to file an amended C-1A Statement of Candidate indicating they are now a 'C' box candidate and file an initial C-5 report within 5 days of exceeding the $500 threshold. Please note that personal funds are included in the $500 threshold, as is the filing fee.

As of October 2019, and in accordance with 13-37-225 and 226 MCA, all candidates must:

- - File all forms electronically in the Campaign Electronic Reporting System (CERS). This includes the C-1 or C-1 Statement of Candidate. Reference Part 1 (Create an Account and File a Statement of Candidate) in the Candidate's Guide to Navigating CERS.

- - To help you file campaign finance forms confidently, reference the the Candidate's Guide to Navigating CERS.

- - All candidates will follow the same reporting schedule (See the Reporting Calendars page for report periods and report due dates).

The Access ID is a unique code generated by the CERS system (and emailed) after a candidate or committee files in CERS. The Access ID links the CERS profile with the ePass account.

Note: It’s important to know that ePass is a State of Montana application that is not unique to the COPP but is used as a portal to access a variety of statewide resources. While users must use ePass to log into their CERS profile, the two systems are different. Whereas CERS is administered directly by the COPP, ePass is not. If you have issues accessing your ePass account, contact the State of Montana help desk at (406) 449-3468.

Entering the Access ID in CERS will prompt you to re-file the Statement of Candidate/Committee, successful filing of which will tie your CERS profile to the ePass account you used to log into the system, and ensures that any data or information you have entered in CERS (registration, financial reports, etc.) is available each time you log in using that specific ePass account.

If you do not have the Access ID for a CERS profile, or you are trying to access CERS via an ePass account beyond the two already tied to the CERS profile, the COPP may be able to assist you. To do this, contact the COPP by emailing cppcompliance@mt.gov, and include the following information:

- 1. Your relationship to the campaign or committee, and

- 2. The reasons you need the ID reset.

WHO IS REQUIRED TO FILE C-5 REPORTS?

If a candidate’s campaign meets or exceeds $500.00 in combined expenditures (expenses) and contribution activity—meaning that the total sum of contributions (including personal contributions) received by the campaign plus expenditures made is $500.00 or more—the candidate is required to file periodic C-5 campaign finance reports with the COPP. Candidates who do not meet or exceed the $500.00 threshold during the duration of their campaign are not required to file C-5 financial reports.

Pursuant to Montana Code Annotated § 13-37-225, each candidate for statewide and state district offices shall account for all contributions received and expenditures made by or on behalf of the candidate by filing periodic reports. A report must be filed even if no money has been received or expended.

Each candidate for county, municipal, and class one school district trustee offices are required to file periodic reports if contributions received, including personal funds, exceed $500 or if expenditures exceed $500.

C-5 Reports must be regularly reported. See this Reporting Calendars page to know when you must file C-5 reports in CERS. Reference MCA 13-37 for all campaign finance information, including report filing timelines (13-37-226), time periods covered by reports (13-37-228), and disclosure requirements (13-37-229).

WHEN ARE C-5 REPORTS DUE?

Candidates are responsible for familiarizing themselves with the legal requirements in the Montana Code Annotated. Candidates can use the MCA to determine report dates using Montana Code Annotated §13-37-226(2)). See 'Reporting Calendars' Tab

A candidate’s filing fee is a mandatory expense to report in a C-5 Form. This can be paid either out of the candidate’s account, reported as an in-kind candidate contribution (if the candidate does not want to be reimbursed for the expense) or as a candidate loan (if the candidate wants to be reimbursed for the expense). If the candidate has already registered as a candidate with the COPP and accepted contributions, they can use these contributions to pay for the filing fee.

Filing fees are not paid to the Office of Political Practices. If you are running for a statewide office or state district office, your filing fee will be handled by the Secretary of State. If you are running for a county office, you will pay your filing fee to your county.

No fees are charged to file your Statement of Candidacy and any campaign finance reports with the COPP.

Campaign Banking Information and Requirements

To open a campaign depository, campaigns may use “a bank, credit union, savings and loan association, or building and loan association authorized to transact business in Montana may be designated as a campaign depository”, 13-37-205, MCA. Please note that all Montana banks now require an EIN number. An EIN (Employer Identification Number) is a banking requirement and not a COPP requirement. The COPP does not give nor need your campaign's EIN. That said, we get quite a few questions about EINs.

A candidate must apply for an EIN through the IRS. You can find more EIN application info at the IRS' website.

Do I need to establish separate bank accounts for both the primary and general election?

Legislative candidates:

No. 13-37-205(6), MCA, allows legislative candidates to deposit primary and general election funds in the same account, as long as:

- The candidate maintains records concerning whether contributions were designated for the primary or general election; and

- The balance in the account does not drop below the amount of general election contributions received until after the primary election

- Yes, if participating in a contested primary election. Under 44.11.224, ARM, primary and general election funds must be separated. Leftover primary election funds may be moved to the general election account at the conclusion of the primary election if no outstanding debts or loans are owed.

- If not participating in a contested primary election, the candidate could only accept contributions for one election, the general election. No need for separate primary and general election accounts.

Yes. However, because these are separate elections, a candidate must properly report each contribution received as either a primary or general contribution, and the money raised for each election must be kept in separate campaign accounts (see the section above).

There’s no requirement that a campaign account be closed within a specific time-frame or by a certain date. The statute says a “closing report shall be filed following an election whenever all debts and obligations are extinguished and no further contributions or expenditures will be received or made which relate to the campaign. . . ” (13-37-228(3), MCA.)

Post-Election Options for a Campaign Account

First, every candidate must file a closing report.

When should a campaign file a closing report? A campaign should file a closing report when all campaign debts and obligations are satisfied and no further campaign activity (e.g. contributing campaign funds to a candidate) is anticipated to occur. If a campaign still needs to pay down debt, accept contributions, or spend campaign funds, they must keep their campaign "open" and therefore should not file a closing report.

- - A campaign must not file a C-5 if they are still paying off debt or plan to continue to accept contributions post-election. Read this tab for information about post-election debt.

- - A campaign can file a closing C-5 report even if they have excess campaign funds. Once a campaign files a C-5 closing report, excess funds must now comply with surplus funds requirements, and the campaign has 120 days to disperse of the funds. Read more about the specific campaign finance reporting and form requirements for surplus funds at this tab.

- - Some campaigns have continued to make expenditures after the election that are not campaign related. This is not allowable.

- - If all of the debts and obligations of the campaign have been met, the closing report has been filed, and there is still a balance in the campaign account the campaign has several options to choose from to dispose of the surplus funds or property. Reference Tab 2 and Tab 3 for information on surplus campaign fund options.

HOW TO FILE A CLOSING REPORT

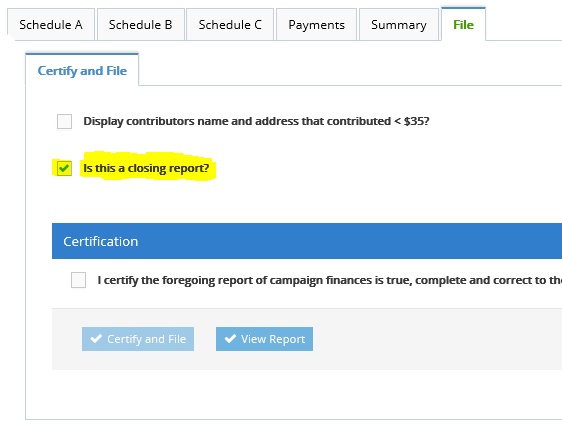

A closing report is simply a final C-5 that is filed as a closing report. This can also be the candidate's required post-general C-5 report. To file a report as a closing report, simply check the "Is this a closing report" box on the File tab (see below image), certify the information is true, complete, and correct, and file the report.

Surplus Primary Funds

- * If you don't advance to the general after the primary election, and your primary campaign account has surplus funds and remains open (meaning that you have not filed a closing C-5 report), you have the below options for the funds. A candidate may:

- 1) Return the contributions to contributors,

2) Donate the funds to a non-profit (this must be reported in a C-5 report as a campaign expenditure) - see 44.11.702, ARM

- see COPP-2017-AO-003

- Note: You can keep your campaign account open (i.e. not file a closing C-5 report) in order to pay back outstanding debts and loans, and solicit contributions to pay off already-established campaign debts (these contributions are subject to contribution limits per election). Once you have settled all campaign debts and will have no further campaign related activity (i.e. accepting contributions, dispersing excess funds, etc.), you can file a C-5 closing report. Remember, every candidate must file a closing report. For more information on filing a C-5 closing report, reference Tab 1.

- Note: Once a candidate has filed a closing C-5 report, the candidate may not contribute surplus campaign funds to another campaign, including the candidate's own future campaign (for example, running for the same office during the next election), or use the funds for personal benefit (which applies to a campaign account at every single of the campaign process and timeline).

- 1) Return the contributions to contributors,

- * If you advance to the general election, leftover funds may be moved from a candidate's primary account to the general account. To report this in a C-5, report the transfer in the C-5 that covers the date the money was transferred. You will report the removal of money from the primary account as a primary expenditure under Schedule B. Then, you will report the transfer of the primary funds to your general campaign account under Schedule A, as a general fundraiser contribution.

Your options depend on if you plan to have money in your account after your required post-general C-5

1) If you dispose of all campaign funds by your post-general C-5 reporting deadline, all transactions can be detailed on the post-general C-5 report. Your options to dispose of funds by the post-general C-5 due date include:

a. Return the funds to contributors. These returned contributions would be reported in your post-general C-5 report as an expenditure. You must include the full name and mailing address of the recipient.

b. Donate the funds to a nonprofit. Report this transaction in a C-5 report as an expense.

c. After the post-general report, you can keep your campaign account open (i.e. not file a closing C-5 report) in order to pay back outstanding debts and loans, and solicit contributions to pay off already-established campaign debts (these contributions are subject to contribution limits per election). Once you have settled all campaign debts and will have no further campaign related activity (i.e. accepting contributions, dispersing excess funds, etc.), you can file a C-5 closing report. Remember, every candidate must file a closing report. For more information on filing a C-5 closing report, reference Tab 1.

2) If you have funds remaining after the post-general C-5 report deadline, you must dispose of the surplus funds within 120 days after you've filed your closing C-5 campaign finance report (Reference Tab 1 for C-5 closing report details). You have the following options for the surplus funds:

a. Donate the funds to a nonprofit. These donations must be reported on a C-118 campaign finance form.

b. If elected, you can establish a constituent services account. Only statewide, state district, and public service commission elected officials have the option to open a constituent services account. This requires you to file a C-118C form and put the money in a bank account with "constituent services" in the account title. Please note that there are specific legal requirements for a constituent services account. Funds in a constituent services account are restricted to being used for certain activities and require detailed accounting and period reports. See 13-37-204 and 402, MCA and 44.11.701, 44.11.703-705, 44.11.707-711 ARM.

c. You can keep your campaign account open (i.e. not file a closing C-5 report) in order to pay back outstanding debts and loans, and solicit contributions to pay off already-established campaign debts (these contributions are subject to contribution limits per election). Once you have settled all campaign debts and will have no further campaign related activity (i.e. accepting contributions, dispersing excess funds, etc.), you can file a C-5 closing report. Remember, every candidate must file a closing report. For more information on filing a C-5 closing report, reference Tab 1.

Once you've filed a closing campaign finance report, all candidates with surplus funds are required to file either a C-118 form or a C-118 C form (MCA 13-37-240).

- Who must file a C-118 form? Following the filing of a closing campaign finance report, all candidates with surplus campaign funds are required to file a Form C-118, pursuant to Montana Code Annotated § 13-37-240.

- Required information to report: In the C-118 form, you must report any spent campaign finance funds, and include copies of receipts to show how you've spent funds (pursuant to 44.11.702, ARM).

For example, if you choose to donate your campaign funds to a nonprofit, you must have proof of this transaction.

- When must a C-118 form be filed? Within 120 days of filing a closing campaign finance report, a candidate must dispose of surplus campaign funds. Form C-118 must be filed by a candidate within 135 days after a closing report is filed.

Do you plan to open a constituent services account? If so, you must file a C-118 C form. You will need to include a copy of the transaction where you've moved money from a campaign account to a constituent services account. The C-118 C form must be filed with 135 days after you've filed a closing campaign report. Any candidate who opens a constituent services account is required to file C-8 reports (see the Constituent Services Accounts dropdown tabs below for more detail).

How can I file my C-118 and C-118 C forms? The candidate must retain one copy for their records, and file a copy with the COPP by:

-

1. Emailing the scanned C-118 form to cppcompliance@mt.gov,

2. Mailing the form to PO Box 202401, Helena MT 59620-2401, or

3. Faxing the form to 406-444-1643 (We advise emailing or calling 444-4942 to ensure your fax was sent through), and

4. Delivering a hard copy of the form(s) in person to the COPP's office at 1209 8th Avenue (one block north of the capitol).

A C-118 hard copy form must be filed with the Commissioner of Political Practices within 120 after your closing C-5 report is filed. The C-118 must be emailed to cppcompliance@mt.gov, faxed to 406-444-1643, or mailed to P.O. Box 202401 (Helena, MT, 59620-2401).

To pay down campaign debt, you can continue to receive contributions after an election.

For example, if you have primary campaign debt, whether you continue to the primary election or not, you can continue to receive primary contributions to pay the campaign loans or debts down. Please note that contribution limits apply, they apply per election, and each contribution must be designated for either your campaign’s primary or general account and kept separate. Only primary contributions can be applied to primary loans or debts, and only general contributions can be applied to general loans or debts. You cannot, for example, pay primary campaign debts down with general campaign contributions. You can continue to receive contributions designated for a specific campaign as long as the individual or entity has not reached their contribution limit for that specific election. This explains why general election contributions cannot be applied retroactively to debt accrued and reflected by your primary campaign account.

If you will no longer seek out contributions to pay for your campaign's debts or loans, you have a few options to close your account and settle outstanding loans and debts:

- 1. You can forgive loans you made, as the candidate, to your campaign. To do this, simply email the COPP at cppcompliance@mt.gov and state, "I am forgiving my candidate loan of $XXXX money for my campaign."

- 2. If your campaign owes outstanding loans and/or debts made to entities that are not yourself (e.g. to a printing company, a vendor, a business, etc.), you may use your personal funds (not your campaign funds) to pay off those obligations.

You will report this as an in-kind loan to your campaign (under Schedule A, Loans [Use the blue "Use Candidate" button in the "Entity Search" section], list the "Purpose" as "campaign debt/loan repayment," or something similar). This will then create a candidate loan for the pending loans or debt balance. Your account will continue to reflect a negative balance with this in-kind candidate loan.

Then, 'forgive' this 'new' loan by emailing cppcompliance@mt.gov and stating in the email that you will not personally seek reimbursement from the campaign for this in-kind loan, and that the loan was made to pay off existing campaign obligations. You must include the 1) vendor, 2) date, and 3) amount information for those obligations in the email. This explanation is needed because your CERS account will continue to reflect a negative balance for the campaign even after this activity.

First, the loan must have already been reported as a loan in a previous C-5 report. Once you pay yourself from your campaign bank account, this amount must be reported in the “Payments” section. Once you’ve paid off all debts and loans, your campaign bank account can then be closed.

If you made a personal loan to your campaign, you also have the option to forgive the amount of your personal loan (and not pay yourself back). If you choose this option, please email cppcompliance@mt.gov and note: 1) your campaign name (E.g. Johnson for HD 15, YEAR) and 2) the amount of the forgiven loan.

There’s no requirement that a campaign account be closed within a specific time-frame or by a certain date. Montana statute says a “closing report shall be filed following an election whenever all debts and obligations are extinguished and no further contributions or expenditures will be received or made which relate to the campaign. . . ” (13-37-228(3), MCA.)

For more information on closing C-5 reports, reference the first tab (above) for information on filing a closing report.

A constituent services account is an account that can be established by an elected candidate to pay for constituent services (MCA 13-37-229) . Only statewide, state district, and public service commission elected officials have the option to open a constituent services account. A constituent services account may be established by filing an appropriate form with the commissioner. A successful candidate may deposit only surplus campaign funds in a constituent services account.

For details about establishing and reporting requirement for a constituent services account, see the next tabbed section below on this web page, "Constituent Services Accounts."

Constituent Services Accounts

A constituent services account is an account that can be established to pay for constituent services by a successful candidate (Only statewide, state district, and public service commission elected officials have the option to open a constituent services account.) required to report under 13-37-229. A constituent services account may be established by filing an appropriate form with the commissioner. A successful candidate may deposit only surplus campaign funds in a constituent services account.

The 2007 legislation formalized restrictions on spending these funds, and strictly limited what money can be placed in the account. Detailed reporting requirements were added. Rules were completed in September 2008 following a comment period and hearing. Legislation passed in 2009 (HB 622) requires that “pre-existing accounts” be promptly closed. It also expanded the list of eligible elected officials to include certain local officials. (Those who are required to disclose campaign contributions and expenditures under Sections 13-37-229 and 230, MCA are now eligible to hold a constituent services account.)

The money in the account may be used only for constituent services. The money in the account may not be used for personal benefit. Expenditures from a constituent services account may not be made when the holder of the constituent services account also has an open campaign account.

A person described in MCA 13-37-402 subsection (1) may not establish any account related to the public official's office other than a constituent services account. This subsection does not prohibit a person from establishing a campaign account.

The holder of a constituent services account shall file a quarterly report with the commissioner, by a date established by the commissioner by rule. The report must disclose the source of all money deposited in the account and enumerate expenditures from the account. The report must include the same information as required for a candidate required to report under 13-37-229. The report must be certified as provided in 13-37-231.

The holder of a constituent services account shall close the account within 120 days after the account holder leaves public office.

Only statewide, state district, and public service commission elected officials have the option to open a constituent services account.

Separate accounts are encouraged to simplify accounting. However, some candidates choose to use their existing campaign accounts and just change the name on the account.

If you use your existing account, supporting documentation must accompany the Form C-118C. It must include proof of the name change and verification of the amount remaining in the account -- the remaining balance in a closing report for the campaign account must be the same as the opening balance in the constituent services account.

When must a C-118C be filed? Within 120 days of filing a closing campaign finance report, a candidate must dispose of surplus campaign funds. Form C-118 must be filed by a candidate within 135 days after a closing report is filed.

What information must be reported when a C-118C is filed? Pursuant to 13-37-240, MCA, the candidate

shall disclose the establishment of a constituent services account. The Form C-118C shall be accompanied by a copy of the transaction between the campaign account and the constituent account. A bank statement showing the transaction satisfies this requirement.

How do I file a C-118C?

A C-118C form must both be filed with the Commissioner of Political Practices. The forms can be filed by:

1- Emailing the scanned C-118 form to cppcompliance@mt.gov,

2- Mailing the form to PO Box 202401, Helena MT 59620-2401, or

3- Faxing the form to 406-444-1643 (We advise emailing or calling 444-4942 to ensure your fax was sent through), and

4- Delivering a hard copy of the form(s) in person to the COPP's office at 1209 8th Avenue (one block north of the capitol).

This form is not submitted through the CERS system. Once a constituent services account is established, regular C-8 reports are required.

A constituent services account must be closed within 120 days after the account holder leaves public office.

A candidate must disclose the details of their constituent services account with quarterly C-8 reports until the account is closed.

- 1- Reports must include all expenditures made and interest accrued through the end of the calendar quarter on which the quarterly report is due.

- 2- All expenditures from a constituent services account must be supported by a written log kept by the candidate or their treasurer. The log must document at least one constituent on whose behalf the constituent services were provided (See 44.11.709 (4) (b), ARM, page 106). This requirement is in keeping with the directive in 13-37-401 and 13-37-402, MCA, that funds only be used for constituent services ("to represent and serve constituents"). The log is to be kept as part of your records -- it's not part of the quarterly reporting.

If you have a constituent services account, you must file a C-8 report on these dates:

- 1. January 10, 2019

- 2. April 10, 2019

- 3. July 10, 2019

- 4. October 10, 2019

C-8 and C-118C forms must be filed by sending a digital or hard copy either via email (cppcompliance@mt.gov), fax (406-444-1643), mail (PO Box 202401, Helena, MT, 59620-2401), or hand delivered (1209 8th Avenue, Helena, Montana).

- C-8 form

- C-118C form

You

may be reimbursed for travel, meal and lodging expenses incurred to provide constituent services (at the rates and reimbursements levels adopted by the Department of Administration). A member of your immediate family may not, however, use your constituent services account for their benefit (See 44.11.107(1)(b) and 44.11.107(2)(c) ARM).

Yes. However, compensation or any other payment to an elected official's immediate family member for time spent or services rendered to provide constituent services is prohibited.

They’re listed in 44.11.707, ARM (beginning on page 102). The list is extensive, so it’s not reproduced here.

Remember that expenditures must be made strictly for services to constituents. Personal use of campaign funds (in this instance, funds now converted to constituent services) is strictly prohibited (See 13-37-240, MCA). If the device will be used to any extent for personal or business use, then only the constituent services portion can be paid with these funds.

When you leave public office, any office supply or equipment purchased with campaign/constituent services account funds that has some remaining value must be donated to charity, or purchased at fair market value with the proceeds donated to charity. (See 44.11.707(3) and (4), ARM.)

No. Constituent services account funds may not be used to pay for direct or indirect expenses related to attendance at a meeting, fundraiser, or gathering at which contributions will be solicited or received by any person, including a political party, political party committee, candidate, or person or committee supporting or opposing a candidate or ballot issue. (See 44.11.706, ARM.)

Political Party Committees are generally established to support or oppose candidates and/or ballot issues; therefore, it’s likely solicitation for or receipt of contributions will

occur at such gatherings. In addition, a constituent services account must be used to represent and serve constituents. It is unlikely that attending a political party event would qualify as a

constituent service.

Payment of expenses related to education, workshops, and conference participation that are incurred to represent and serve constituents is authorized. (See 44.11.707 (1) (g), ARM).

You must close a constituent services account within 120 days after leaving public office (as defined in 44.11.711 (1), ARM).

Surplus constituent services funds may be donated to any organization or entity, so long as the use of the funds will not violate the personal benefit or campaign contribution prohibitions of 13-37-240 and 13-37-402, MCA, and 44.11.711 (2) ARM.

First, remember that no money from a constituent account can be used for any campaign activity, whether for your campaign or another person's campaign; The money in the account may be used only for constituent services. The money in the account may not be used for personal benefit. Expenditures from a constituent services account may not be made when the holder of the constituent services account also has an open campaign account (See MCA 13-37-240 and MCA 13-37-402).

With that understanding:

- If you are running for the 1) same office and 2) in the same district, you do not need to create a new constituent services account and can re-use your previous account information once you are re-elected.

- If you are running for 1) a new office or 2) in another district, you cannot use a previous constituent services account and will need to create a new constituent services account.

All records and reports filed must be maintained for 4 years after the constituent services account is closed.