Post-Election (Primary or General) Options for Campaign Accounts

The information below walks candidates through their optins if they: 1) continue to the general election after the primary, 2) do not continue after the primary, 3) want to open a constituent services account, 4) need to file a closing report, or 5) have end-of-campaign bank account questions.

All candidates are legally required to follow Montana's campaign finance laws. To ensure you understand what is required of you, familiarize yourself with 44.11.701, MCA. As always, please contact the office of the Commissioner of Political Practices with questions at (406) 444-2942, email cpphelp@mt.gov, or stop in at the Helena office at 1209 8th Avenue.

Post-Election Options for a Campaign Account

First, every candidate must file a closing report.

When should a campaign file a closing report? A campaign should file a closing report when all campaign debts and obligations are satisfied and no further campaign activity (e.g. contributing campaign funds to a candidate) is anticipated to occur. If a campaign still needs to pay down debt, accept contributions, or spend campaign funds, they must keep their campaign "open" and therefore should not file a closing report.

- - A campaign must not file a C-5 if they are still paying off debt or plan to continue to accept contributions post-election. Read this tab for information about post-election debt.

- - A campaign can file a closing C-5 report even if they have excess campaign funds. Once a campaign files a C-5 closing report, excess funds must now comply with surplus funds requirements, and the campaign has 120 days to disperse of the funds. Read more about the specific campaign finance reporting and form requirements for surplus funds at this tab.

- - Some campaigns have continued to make expenditures after the election that are not campaign related. This is not allowable.

- - If all of the debts and obligations of the campaign have been met, the closing report has been filed, and there is still a balance in the campaign account the campaign has several options to choose from to dispose of the surplus funds or property. Reference Tab 2 and Tab 3 for information on surplus campaign fund options.

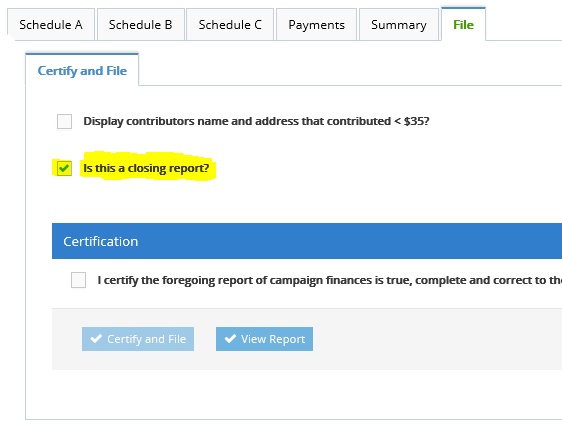

HOW TO FILE A CLOSING REPORT

A closing report is simply a final C-5 that is filed as a closing report. This can also be the candidate's required post-general C-5 report. To file a report as a closing report, simply check the "Is this a closing report" box on the File tab (see below image), certify the information is true, complete, and correct, and file the report.

Surplus Primary Funds

- * If you don't advance to the general after the primary election, and your primary campaign account has surplus funds and remains open (meaning that you have not filed a closing C-5 report), you have the below options for the funds. A candidate may:

- 1) Return the contributions to contributors,

2) Donate the funds to a non-profit (this must be reported in a C-5 report as a campaign expenditure) - see 44.11.702, ARM

- see COPP-2017-AO-003

- Note: You can keep your campaign account open (i.e. not file a closing C-5 report) in order to pay back outstanding debts and loans, and solicit contributions to pay off already-established campaign debts (these contributions are subject to contribution limits per election). Once you have settled all campaign debts and will have no further campaign related activity (i.e. accepting contributions, dispersing excess funds, etc.), you can file a C-5 closing report. Remember, every candidate must file a closing report. For more information on filing a C-5 closing report, reference Tab 1.

- Note: Once a candidate has filed a closing C-5 report, the candidate may not contribute surplus campaign funds to another campaign, including the candidate's own future campaign (for example, running for the same office during the next election), or use the funds for personal benefit (which applies to a campaign account at every single of the campaign process and timeline).

- 1) Return the contributions to contributors,

- * If you advance to the general election, leftover funds may be moved from a candidate's primary account to the general account. To report this in a C-5, report the transfer in the C-5 that covers the date the money was transferred. You will report the removal of money from the primary account as a primary expenditure under Schedule B. Then, you will report the transfer of the primary funds to your general campaign account under Schedule A, as a general fundraiser contribution.

Your options depend on if you plan to have money in your account after your required post-general C-5

1) If you dispose of all campaign funds by your post-general C-5 reporting deadline, all transactions can be detailed on the post-general C-5 report. Your options to dispose of funds by the post-general C-5 due date include:

a. Return the funds to contributors. These returned contributions would be reported in your post-general C-5 report as an expenditure. You must include the full name and mailing address of the recipient.

b. Donate the funds to a nonprofit. Report this transaction in a C-5 report as an expense.

c. After the post-general report, you can keep your campaign account open (i.e. not file a closing C-5 report) in order to pay back outstanding debts and loans, and solicit contributions to pay off already-established campaign debts (these contributions are subject to contribution limits per election). Once you have settled all campaign debts and will have no further campaign related activity (i.e. accepting contributions, dispersing excess funds, etc.), you can file a C-5 closing report. Remember, every candidate must file a closing report. For more information on filing a C-5 closing report, reference Tab 1.

2) If you have funds remaining after the post-general C-5 report deadline, you must dispose of the surplus funds within 120 days after you've filed your closing C-5 campaign finance report (Reference Tab 1 for C-5 closing report details). You have the following options for the surplus funds:

a. Donate the funds to a nonprofit. These donations must be reported on a C-118 campaign finance form.

b. If elected, you can establish a constituent services account. Only statewide, state district, and public service commission elected officials have the option to open a constituent services account. This requires you to file a C-118C form and put

the money in a bank account with "constituent services" in the account title. Please note that there are specific legal requirements for a constituent services account. Funds in a constituent services account are restricted to being used for certain activities and require detailed accounting and period reports. See 13-37-204 and 402, MCA and 44.11.701, 44.11.703-705, 44.11.707-711 ARM.

c. You can keep your campaign account open (i.e. not file a closing C-5 report) in order to pay back outstanding debts and loans, and solicit contributions to pay off already-established campaign debts (these contributions are subject to contribution limits per election). Once you have settled all campaign debts and will have no further campaign related activity (i.e. accepting contributions, dispersing excess funds, etc.), you can file a C-5 closing report. Remember, every candidate must file a closing report. For more information on filing a C-5 closing report, reference Tab 1.

Once you've filed a closing campaign finance report, all candidates with surplus funds are required to file either a C-118 form or a C-118 C form (MCA 13-37-240).

- Who must file a C-118 form? Following the filing of a closing campaign finance report, all candidates with surplus campaign funds are required to file a Form C-118, pursuant to Montana Code Annotated § 13-37-240.

- Required information to report: In the C-118 form, you must report any spent campaign finance funds, and include copies of receipts to show how you've spent funds (pursuant to 44.11.702, ARM).

For example, if you choose to donate your campaign funds to a nonprofit, you must have proof of this transaction.

- When must a C-118 form be filed? Within 120 days of filing a closing campaign finance report, a candidate must dispose of surplus campaign funds. Form C-118 must be filed by a candidate within 135 days after a closing report is filed.

Do you plan to open a constituent services account? If so, you must file a C-118 C form. You will need to include a copy of the transaction where you've moved money from a campaign account to a constituent services account. The C-118 C form must be filed with 135 days after you've filed a closing campaign report. Any candidate who opens a constituent services account is required to file C-8 reports (see the Constituent Services Accounts dropdown tabs below for more detail).

How can I file my C-118 and C-118 C forms? The candidate must retain one copy for their records, and file a copy with the COPP by:

-

1. Emailing the scanned C-118 form to cppcompliance@mt.gov,

2. Mailing the form to PO Box 202401, Helena MT 59620-2401, or

3. Faxing the form to 406-444-1643 (We advise emailing or calling 444-4942 to ensure your fax was sent through), and

4. Delivering a hard copy of the form(s) in person to the COPP's office at 1209 8th Avenue (one block north of the capitol).

A C-118 hard copy form must be filed with the Commissioner of Political Practices within 120 after your closing C-5 report is filed. The C-118 must be emailed to cppcompliance@mt.gov, faxed to 406-444-1643, or mailed to P.O. Box 202401 (Helena, MT, 59620-2401).

To pay down campaign debt, you can continue to receive contributions after an election.

For example, if you have primary campaign debt, whether you continue to the primary election or not, you can continue to receive primary contributions to pay the campaign loans or debts down. Please note that contribution limits apply, they apply per election, and each contribution must be designated for either your campaign’s primary or general account and kept separate. Only primary contributions can be applied to primary loans or debts, and only general contributions can be applied to general loans or debts. You cannot, for example, pay primary campaign debts down with general campaign contributions. You can continue to receive contributions designated for a specific campaign as long as the individual or entity has not reached their contribution limit for that specific election. This explains why general election contributions cannot be applied retroactively to debt accrued and reflected by your primary campaign account.

If you will no longer seek out contributions to pay for your campaign's debts or loans, you have a few options to close your account and settle outstanding loans and debts:

- 1. You can forgive loans you made, as the candidate, to your campaign. To do this, simply email the COPP at cppcompliance@mt.gov and state, "I am forgiving my candidate loan of $XXXX money for my campaign."

- 2. If your campaign owes outstanding loans and/or debts made to entities that are not yourself (e.g. to a printing company, a vendor, a business, etc.), you may use your personal funds (not your campaign funds) to pay off those obligations.

You will report this as an in-kind loan to your campaign (under Schedule A, Loans [Use the blue "Use Candidate" button in the "Entity Search" section], list the "Purpose" as "campaign debt/loan repayment," or something similar). This will then create a candidate loan for the pending loans or debt balance. Your account will continue to reflect a negative balance with this in-kind candidate loan.

Then, 'forgive' this 'new' loan by emailing cppcompliance@mt.gov and stating in the email that you will not personally seek reimbursement from the campaign for this in-kind loan, and that the loan was made to pay off existing campaign obligations. You must include the 1) vendor, 2) date, and 3) amount information for those obligations in the email. This explanation is needed because your CERS account will continue to reflect a negative balance for the campaign even after this activity.

First, the loan must have already been reported as a loan in a previous C-5 report. Once you pay yourself from your campaign bank account, this amount must be reported in the “Payments” section. Once you’ve paid off all debts and loans, your campaign bank account can then be closed.

If you made a personal loan to your campaign, you also have the option to forgive the amount of your personal loan (and not pay yourself back). If you choose this option, please email cppcompliance@mt.gov and note: 1) your campaign name (E.g. Johnson for HD 15, 2018) and 2) the amount of the forgiven loan.

There’s no requirement that a campaign account be closed within a specific time-frame or by a certain date. Montana statute says a “closing report shall be filed following an election whenever all debts and obligations are extinguished and no further contributions or expenditures will be received or made which relate to the campaign. . . ” (13-37-228(3), MCA.)

For more information on closing C-5 reports, reference the first tab (above) for information on filing a closing report.

A constituent services account is an account that can be established by an elected candidate to pay for constituent services (MCA 13-37-229) . Only statewide, state district, and public service commission elected officials have the option to open a constituent services account. A constituent services account may be established by filing an appropriate form with the commissioner. A successful candidate may deposit only surplus campaign funds in a constituent services account.

For details about establishing and reporting requirement for a constituent services account, see the next tabbed section below on this web page, "Constituent Services Accounts."

Continuing Service Accounts

A continuing service account is an account that can be established to pay for constituent services by a certain elected officials*. Elected officials establish a continuing service account by filing form C-118C with COPP. Any continuing service account must be established within 120 days of filing a Closing campaign finance report. A successful candidate may deposit only surplus campaign funds into a continuing service account.

The money in the account may be used only for constituent services. The money in the account may not be used for personal benefit.

The holder of a continuing service account shall file quarterly reports with the commissioner, on the 10th of April (January-March activity), July (April-June), October (July-September), and January (October-December). The report must disclose the source of any funds deposited into (which can include bank interest) and expenditures made from the account. The report must include the same information as required for a candidate required to report under 13-37-229. The report must be certified as provided in 13-37-231.

*Eligible officials are: Governor; Lt. Governor; Attorney General; Secrtary of State; State Auditor; Superintendent of Public Instruction; Chief Justice or Justice of the Supreme Court; Clerk of the Supreme Court; Public Service Commissioner; Montana Senate; and Montana House of Representatives

Separate accounts are encouraged to simplify accounting. However, some candidates choose to use their existing campaign accounts and just change the name on the account.

If an elected official chooses to utilize the existing campaign bank account to house a continuing service account after being elected to office, supporting documentation must accompany the C-118C submitted to COPP. It must include proof of the name change and verification of the amount remaining in the account -- the remaining balance in a closing report for the campaign account must be the same as the opening balance in the new continuing service account.

Elected officials with an established continuing service account must file quarterly C-8 reports until the account is closed. Reports must include all expenditures made and interest accrued through the end of the calendar quarter on which the quarterly report is due.

All expenditures made from a continuing service account must be supported by a written log kept by the candidate or their treasurer. The log is to be kept as part of your records -- it's not part of the quarterly reporting.

If you have a continuing service account, you must file a C-8 report on these dates:

- April 10 (covers January-March)

- July 10 (covers April-June)

- October 10 (covers July-September)

- January 10 (covers October-December)

Authorized expenditures from a continuing service account are outlined in 44.11.707, ARM. These authorized expenditures keep with the directives in 13-37-401 and 13-37-402, MCA, that funds only be used for constituent services.

You must close a continuing service account within 120 days after leaving public office, pursuant to MCA 13-37-402(5) and ARM 44.11.711.

Surplus constituent services funds may be donated to any organization or entity, so long as the use of the funds will not violate the personal benefit or campaign contribution prohibitions of 13-37-240 and 13-37-402, MCA.

All records and reports filed must be maintained for a period of 2 years after the continuing service account is closed.